Managing money today

Modern money moves fast.

Clarity doesn't.

With digital payments, multiple goals, and constant decisions, it's easy to lose sight of where you stand.

A familiar feeling

Money moves faster than memory.

Today, most spending happens in seconds — a tap, a scan, a swipe.

By the end of the day, it's hard to remember where the money actually went.

Even bank statements show what happened — not why.

This is how plans usually slip.

Plans don't usually fail.

They just slip over time.

You start with good intentions.

You tell yourself you'll get back on track next month.

But without clear signals, small decisions add up.

Before you realize it, your plan has shifted — without you choosing to change it.

What changes with Goal Vest

See where your money actually goes — across all goals.

Your income isn't infinite. Some goals move faster, others slow down.

Goal Vest shows you how your money is allocated — in real time — so you're never guessing which goal you're sacrificing.

No more wondering if you're on track. Just clarity on what's moving forward and what's waiting.

See the full picture

before you decide

Goal Vest shows you how your money is actually being used — across goals, spending, and commitments — so you're not making decisions in isolation.

You can see what's progressing, what's stalled, and what today's choices are affecting.

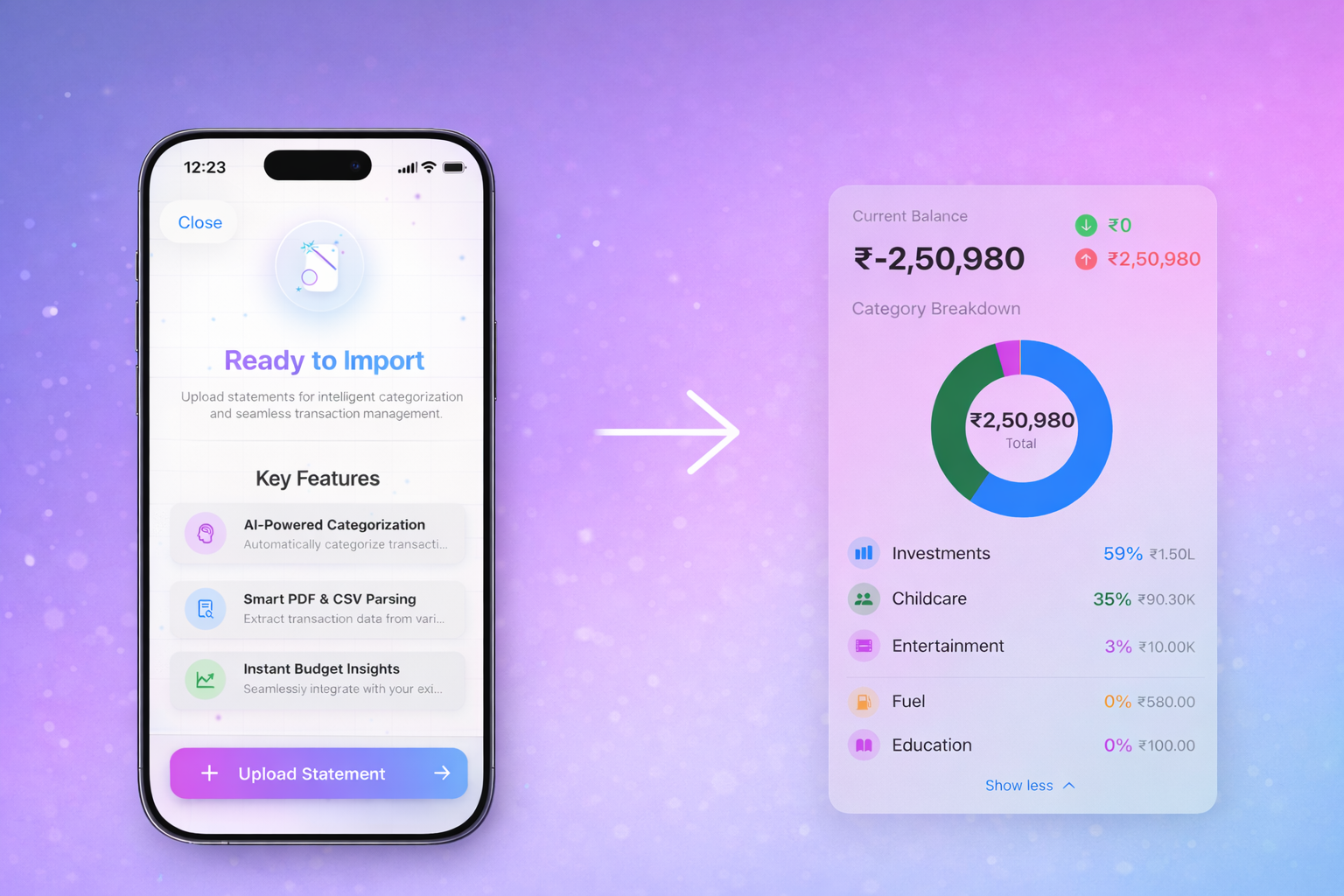

See where your money is going

Transactions update your goals and allocations automatically, whether you add them manually or upload a bank statement.

Plan all goals together

See how your income is split across goals, loans, and savings — and what each choice affects.

Know when something's off

Get clear signals when spending increases, contributions stop, or a small change could improve progress.

Who Goal Vest is built for

Built for you if:

- You're juggling multiple long-term goals at once — home, car, education, emergency fund — and want to see how they actually interact

- You've asked yourself "Am I overcommitting?" more than once — and want clarity before locking into EMIs

- You want to understand trade-offs before committing to big purchases or EMIs

- You prefer privacy and control over sharing bank login credentials with third-party aggregators

- You want to track loans alongside savings and see the full picture

- You value clarity over complexity — thinking clearly, not managing spreadsheets

May not be the best fit if:

- •You're looking for stock tips or crypto signals — we focus on planning, not predictions

- •You're okay with giving your bank password to apps for "convenience" — we prioritize privacy and stability

- •You want pure expense tracking without goal planning — simpler tools exist

- •You prefer to wing big financial decisions and "figure it out later" — Goal Vest is built for planning ahead, not hoping things work out

Goal Vest is flexible — you can use it for budgeting, goal tracking, or loan management. But it's built for one thing above all: helping you think clearly before big financial decisions lock you in.

Interested in Goal Vest?

Get early access to

simpler money decisions

Join the waitlist to get started as soon as we're ready for early users.

No spam or selling your data. Just the occasional update.

Limited spots for early users held to high standards

We'll reach out only when we're ready for you

Priority feature requests and feedback opportunities